Payment Verification

In order for expenses associated with services to be reimbursable, the proofs of payment must be included in the supporting documentation.

Proofs of Payment are documentation that confirm payment has been issued by you (the applicant), processed by financial institution, and received by the vendor. The type of documentation varies based on the type of payment made.*

*See Federal Regulation source in the blue sidebar 44 CFR §13.20(b)(6) and 2 CFR §200.302(b)(3)

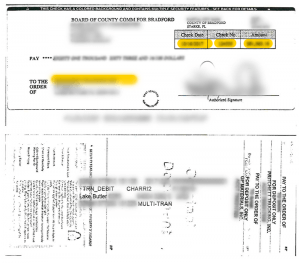

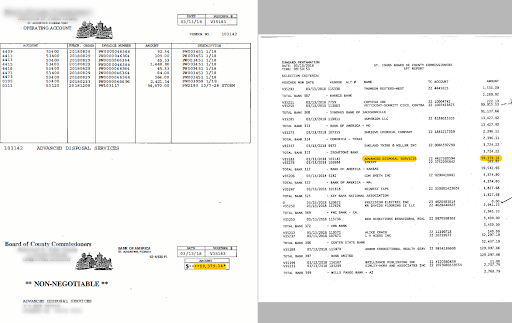

Payment by Check

Image of both Front and Back of check. This is usually a pdf from monthly bank statement or an export from online banking.

The front of the check should clearly show the pay to the order of (matching the vendor/contractor) and dollar amount. The back of the check should show the endorsement and the bank processing stamp/markings.

In unique instances the back of the check may not be available. In those instances, with approval, the front of the issued check and bank statement documentation showing processing of the check by matching the front of check number, dollar amount, as well as documentation of vendor of receipt of check (e.g. a zero balance invoice, a letter on letterhead) may be used.

Payment by Credit Card

Image of the credit card statement showing the charge (in addition to/separate from the original invoice/receipt for the purchase); as well as the proof of payment (usually a check) to the credit card company (see above requirements for standard of documentation for payment by check). In some instances, the follow-on statement from the credit card company may be required as supporting documentation that the payment was received and the balance was zeroed out.

Payment by ACH

An ACH transfer is the electronic movement of money between banks through the Automated Clearing House network, one of the biggest U.S. payment systems. The types of transfers include external funds transfers, person-to-person payments, bill payments and direct deposits from employers and government benefit programs.

Payment by Wire Transfer

A wire transfer is made between two financial institutions by a person issuing instructions to one institution. The instructions include the special bank routing costs to ensure that the wire transfer ends up in the right bank and the right account. The institution then sends the instruction to the recipient, confirming the upcoming transfer. Wire transactions are safe and can be processed same-day. Proof of payment using a wire transfer is usually a transaction register from your bank showing your account balance prior to transaction, the transaction, and the account balance after the transaction is finalized.

Payment by Warrant

Some government agencies use a warrant system. A warrant is a type of “payment order.” It is a written order from the first party that instructs a second party to pay a specific recipient a specific amount of money. A division of a state agency may issue a payment order to the treasurer.

Other Types of Payment

Other types of payments are usually a combo of the above, petty cash reimbursement, or employee reimbursement. No matter the type of payment, the requirement will be “something” that shows the payment was made, received, and processed. An employee reimbursement would likely be an expense or payroll check (see proof of payment requirement for check).

Federal Regulations

44 CFR §13.20(b)(6)

Subpart C–Post-Award Requirements

§13.20 Standards for financial management systems.

“Source documentation. Accounting records must be supported by such source documentation as cancelled checks, paid bills, payrolls, time and attendance records, contract and sub grant award documents, etc.”

2 CFR §200.302(b)(3)

Subpart D–Post-Federal Award Requirements

§200.300 Statutory and national policy requirements.

“Records that identify adequately the source and application of funds for federally-funded activities. These records must contain information pertaining to Federal awards, authorizations, obligations, unobligated balances, assets, expenditures, income and interest and be supported by source documentation.”